In a quest to reduce interest rate manipulation & increase financial transparency, banks and regulators around the world have performed an overhaul of the benchmark interest rates used globally for financial transactions. Corporations and financial institutions have in the past heavily relied upon LIBOR based credit lines, debt/investment contracts & derivatives. As of January 1st 2022 a financial overhaul is in process to phase out LIBOR based interest rates and replace with an entirely new suite of products. SOFR for USD, Sinoa for GBP, Tona for HPY, Saran for CHF, etc. All new financial contracts entered into, in 2022 will use the new line of interest rate products.

SAP’s Response

In response to this change, SAP has released functionality for both ECC and S/4HANA to ensure that the move away from LIBOR based interest rates is a smooth transition. The transaction manager functionality that is required to use the new suite of interest rate products is available by applying a series of SAP notes.

- 2939657 – Composite SAP Note: EU Benchmark Regulation, Risk-Free Rates (RFRs)

- 2932789 – Business function enhancement for Cross-Currency FX Hedging Activation

- 2880124 – Composite SAP Note for Loans Management: EU Benchmark Regulation, Risk-Free Rates

Depending on your release and feature pack, these subsequent notes may be needed to enable full functionality.

- 2991239 – IRSWAP: Parallel Variable Interest Condition

- 2951317 – New FIMA: Incorrect interest rate for condition change with reference interest rate and “For reference interest rate entry” adjustment (2)

- 2911999 – Issue when changing reference interest mark-down/-up value for swaps

- 3037290 –IRSWAP:Parallel Variable Interest Condition, Spread/Formula

- 3062375 – New IRS: TI92 – Missing reference interest rate fields when using parallel conditions as cashflow calculation

Configuration Changes

Once the SAP notes are applied additional functionality is enabled within the transaction manager module. In the following section we discuss the related configuration that is required to enable the required interest calculation types for SAP to generate and calculate the correct cash flows for the Risk-Free Rate contracts.

- Changes to parallel interest conditions

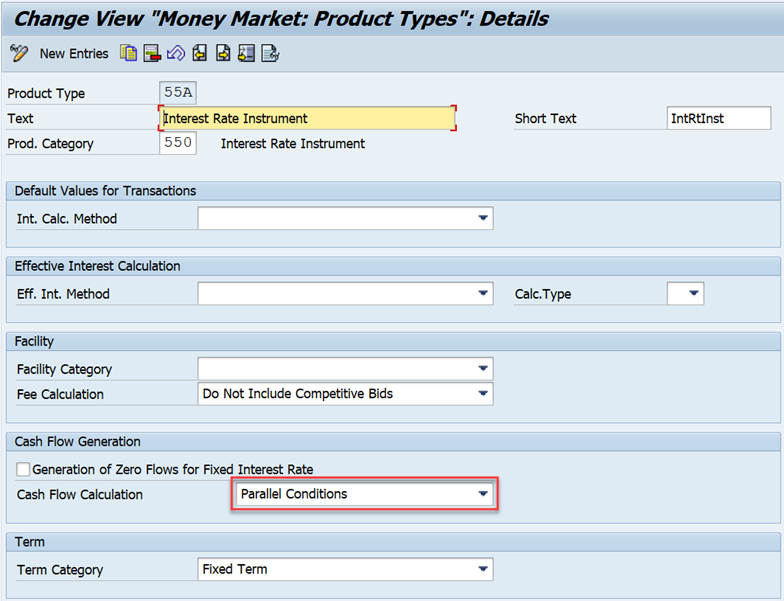

- Money Market contracts and Interest Rate Swaps require an activation by product type. The is enabled by adding the ‘parallel conditions’ selection in the product type configuration for the following Product Categories. (Money Market – 550, 580 and Interest Rate Swaps – 620)

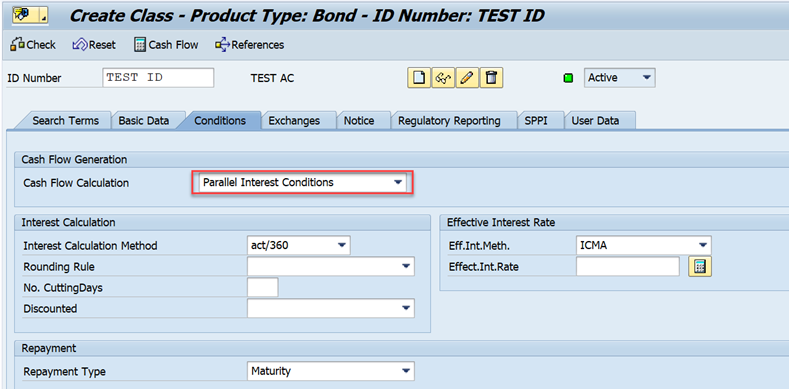

- Bonds do not require an activation by product type. Instead, we select the ‘Parallel Conditions’ Cash Flow Calculation when creating the security ID to enable this functionality.

- Addition of additional fields/entry screen within FTR_CREATE

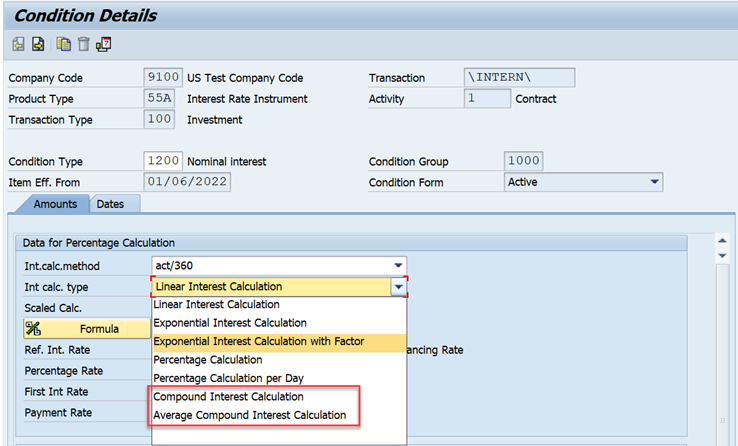

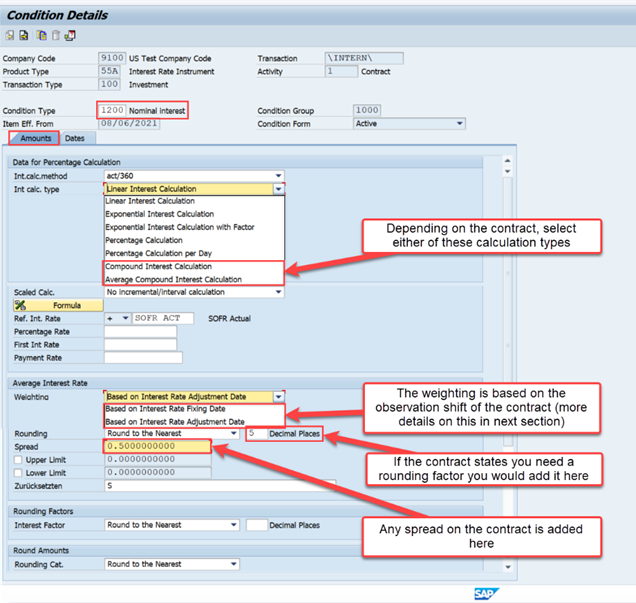

- Once we add the parallel conditions to the contracts, we have two additional Interest Calculation Types that are included in the interest conditions of the contracts. These are:

- Compound Interest Calculation

- Average Compound Interest Calculation

- Once we add the parallel conditions to the contracts, we have two additional Interest Calculation Types that are included in the interest conditions of the contracts. These are:

- The addition of these interest calculation types allow you to generate the correct cash flows for these contracts.

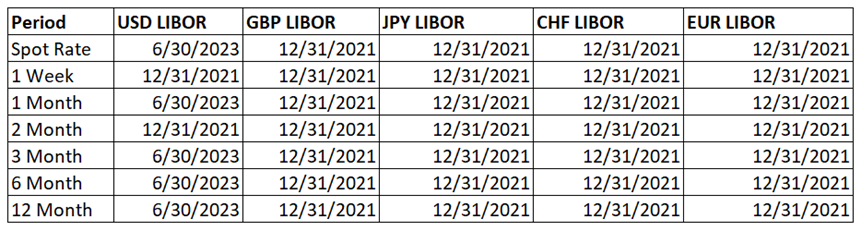

- Revision of USD yield curve to perform mark to market ME valuations

- Since LIBOR is being discontinued as the benchmark for many contracts, we will also need to phase out our reliance on yield curves built on LIBOR rates. Below is a schedule that details when key rates are being discontinued. Since we could have existing USD LIBOR contracts until the rate is fully discontinued in 2023, we will still have contracts that rely on these rates for month end evaluations. Once these rates are no longer reliable, the data points should be removed from our yield curves in SAP. In the below table, you can see that the 1 week and 2 month USD LIBOR rates are no longer being published as of 12/31/2021.

- This table details when each of these rates are being discontinued.

- Additional Yield Curve Requirements

- Since many of these data points have been discontinued, they are not reliable to calculate the Net Present Value for contracts anymore. Yield curves should be reviewed, and new yield curves should be created in SAP to replace these LIBOR based curves.

Contract Entry

How should contracts be entered to consume the new benchmark rates

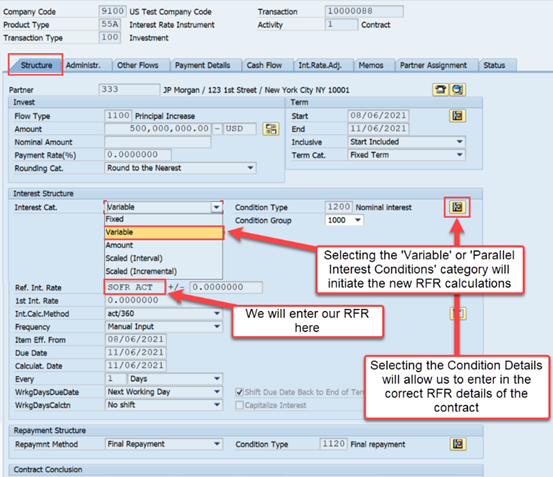

The LIBOR Transition affects mainly Variable Interest Bonds, Interest Rate Instruments, and Interest Rate Swaps in the Transaction Manager module of SAP. The initial creation of these deals doesn’t change much from what you’re familiar with in SAP, the real differences come into play when we change the interest conditions for these deals to Variable or Parallel Interest Conditions. These interest conditions include ‘Compound Interest Calculation’ and ‘Average Compound Interest Calculation’ which have been added to SAP’s interest calculation algorithms for the new Risk Free Rates (RFRs) we’ll be using as we transition away from LIBOR.

Sample Contract Entry: Structure Tab

Sample Contract Entry: Condition Details (1200 Nominal Interest)

Amounts Tab

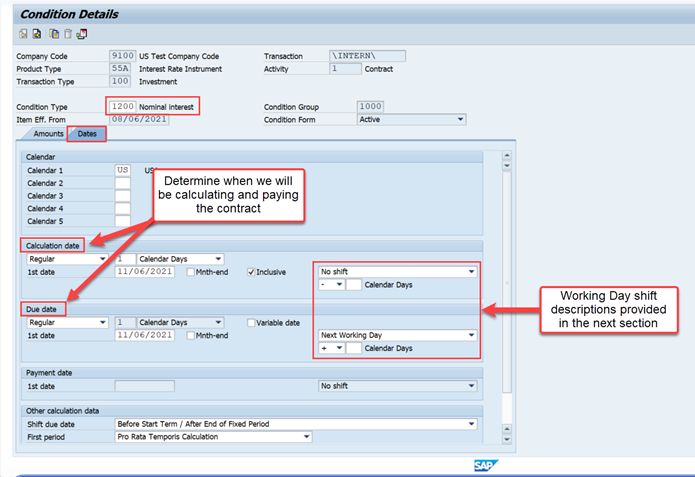

Dates Tab

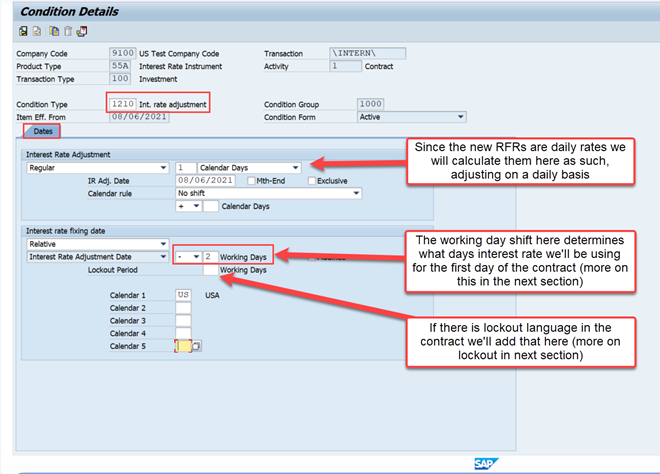

Sample Contract Entry: Condition Details (1210 Interest Rate Adjustment)

Once all the conditions are correctly defined, we can save the contract, subsequent steps from here do not change with these new interest rate conditions.

Cutover of Existing Contracts

Contracts that are currently using the USD LIBOR rates can remain in place until June 30, 2023 when the LIBOR Rates will cease to be published. At that point in time all open contracts will need to change to a new reference interest rate.

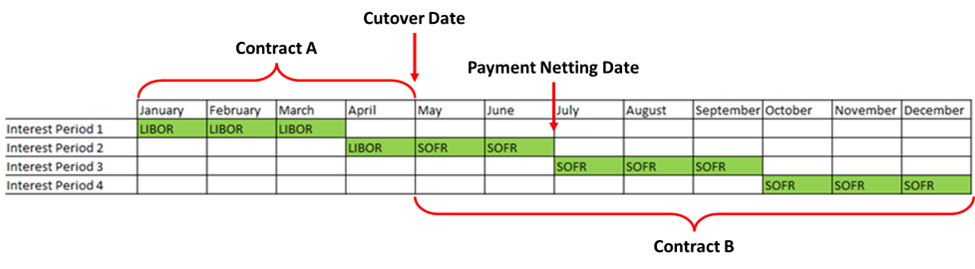

Once we’ve determined we want to cutover a current contract there are a few steps that need to take place.

- First we need to end the existing contract and adjust the payment date to equal the end of the interest period.

- We will then create a new contract with the same structure as the old one, using the applicable RFR and start it that day after the previous contract ends.

- We need to make sure we adjust the first payment date to mirror the last payment date of the old contract so these can be netted together when the payment is due.

The example below illustrates the cutover process.

Tips and tricks

The main issues you can expect to encounter when transitioning from LIBOR to SOFR is the Compound and Average Compound interest calculations can be a bit tricky to master depending on the language of your contracts. Below we’ve highlighted definitions of many of the fields you’ll enter information into for your interest conditions, discrepancies in these areas can throw off your interest calculations and be difficult to pinpoint at times. We can assure you if all the data is correctly entered you will land on the proper calculations.

Deal Terms definitions

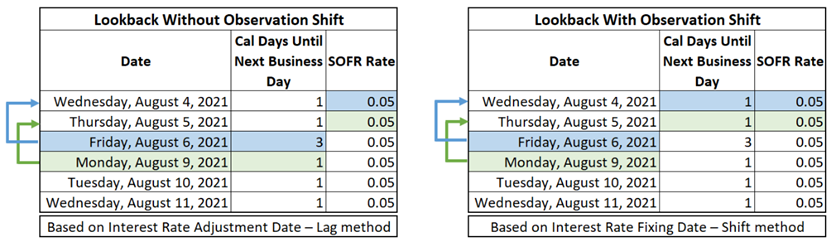

- Look Back – Number of business days prior to the effective date that is used to determine Base Rate

- Observation Shift: The Average Compound Interest formula uses the weighting of calendar days until the next business day in its calculation. When we use the observation shift, we are also shifting the weighting in column ‘B’ below to the date we are capturing SOFR in the observation period. If we don’t use an observation shift the weighting will look at the interest period in column ‘B’.

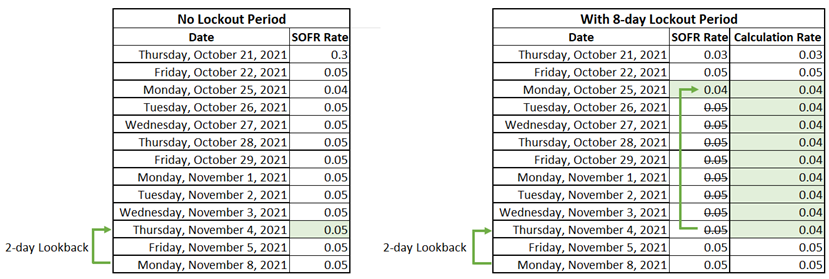

- Lockout – Number of business days at the end of the reporting period from which the prior day’s Base Rate is locked and used instead of the published rate

Example – Not part of the demo contract. Used an 8-day lockout period to demonstrate that the calculation rate stays consistent starting on Oct. 25th through the end of the contract.

- Working Day Shift – Determines what day the calculation date or due date falls on, based on several criteria. (Below definitions from SAP Performance Assistant)

- No Shift

- The day that was manually entered or the beginning/end of the contract.

- Next Working Day

- Following Working Day depending on business calendar chosen

- Modified shift to next working day

- Modified means that the date cannot be shifted from the month in which it falls. If the shift were to cause this to happen, then the date is shifted to the previous working day instead.

- Shift to previous working day

- Previous Working Day depending on business calendar chosen

- Modified shift to previous working day

- Modified means that the date cannot be shifted from the month in which it falls. If the shift would cause this to happen, then the date is shifted to the next working day instead.

- Next working day in same calendar year

- The next working day in the same calendar year means that the date cannot be shifted from the year in which it falls. If the shift were to cause this to happen, then the date is shifted to the previous working day.

- Previous working day in same calendar year

- The previous working day in the same calendar year means that the date cannot be shifted from the year in which it falls. If the shift were to cause this to happen, then the date is shifted to the next working day.

- Shift by number of working days

- The date is shifted by a positive or negative number of working days.

- Next working day in same calendar week

- The next working day in the same calendar week ending on Saturday means that the date cannot be shifted from the week in which it falls. If the shift were to cause this to happen, then the date is shifted to the previous working day.

- No Shift